Highmont-Group.com Review: Understanding Account Tiers and What Traders Actually Get

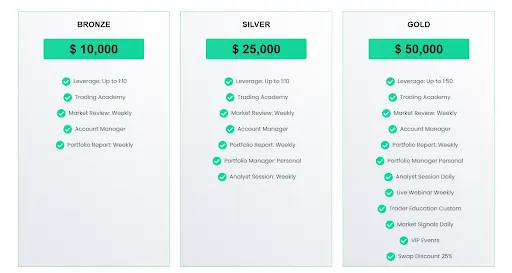

In this Highmont-Group.com review, we dive into a trading platform that structures everything around six account tiers, each unlocking different tools and support levels. Starting at $10,000 for Bronze and climbing to $500,000 for VIP, the tier system determines what features users can access. The platform also offers 160+ CFD assets, real-time analytics, and specialized support that changes significantly between levels.

Account tiers in Highmont Group can either create a clear path to better trading resources or simply lock essential features behind steep paywalls. The distinction becomes critical when your capital requirements jump from five figures to half a million dollars.

The Web-Based Platform Experience

In this Highmont-Group.com review, the browser-only approach stands out immediately. No software downloads means no version updates, no compatibility issues, and no storage space consumed on devices. Users simply open any modern browser and log in.

Traders often switch between devices throughout the day. The web-based terminal keeps everything synced automatically. Speed depends partly on internet connection quality, but the platform handles most processing server-side. Even older computers can run the full platform because the heavy lifting happens remotely.

Asset Classes Breakdown

Cryptocurrency Trading

The platform offers crypto CFDs rather than actual cryptocurrency ownership. Users trade on Bitcoin, Ethereum, and other crypto price movements without holding coins in wallets. This approach sidesteps wallet security concerns and simplifies tax reporting, but users don’t actually own the underlying assets. For example, a user could speculate on the price fluctuation of ETC to EURO without ever needing to purchase or store the Ethereum Classic directly.

Crypto volatility creates both opportunity and risk. Prices can swing 10% or more in hours. A key point in this Highmont-Group.com review is how leverage amplifies these swings significantly. A 5% price move with 10x leverage becomes a 50% account impact.

Forex Market Access

Currency pair selection covers major pairs like EUR/USD, GBP/USD, and USD/JPY, plus minor and exotic pairs. Forex trading happens 24 hours during weekdays as different markets open globally. The platform provides access throughout these hours.

Leverage options for forex vary by account tier. Bronze and Silver users get up to 1:10 leverage. Gold through Diamond jump to 1:50. VIP tier receives custom leverage arrangements based on trading history and capital size.

Indices and Commodities

Major indices include the S&P 500, NASDAQ, FTSE 100, and others. Commodity trading covers oil, natural gas, agricultural products, and more. It must be noted in this Highmont-Group.com review that these assets trade as CFDs, so users speculate on price movements without physical delivery concerns.

Diversification across asset classes helps spread risk. When stock indices drop, commodities might rise. When forex pairs consolidate, crypto might trend strongly. Having access to multiple markets lets traders rotate focus based on current opportunities.

Precious Metals and Shares

Gold and silver trading provides traditional safe-haven exposure. Stock CFDs let users trade major company shares without buying actual stocks. The spread between buying and selling prices determines immediate trading costs.

The Six-Tier Account Structure Explained

Bronze starts at $10,000 minimum deposit and provides trading academy access, weekly market reviews, an account manager, and weekly portfolio reports. The account manager is shared among multiple Bronze users rather than dedicated to individuals.

Silver at $25,000 adds a personal portfolio manager and weekly analyst sessions. This represents the first major support upgrade. Having someone review portfolio construction specifically for individual accounts helps identify imbalances or overexposures.

Gold at $50,000 brings daily analyst sessions, weekly webinars, custom trader education, daily market signals, VIP event access, and 25% swap discounts. A few more insights in this Highmont-Group.com review include how daily signals differ from weekly market reviews. Signals suggest specific trade setups with entry and exit points, while reviews discuss broader market conditions.

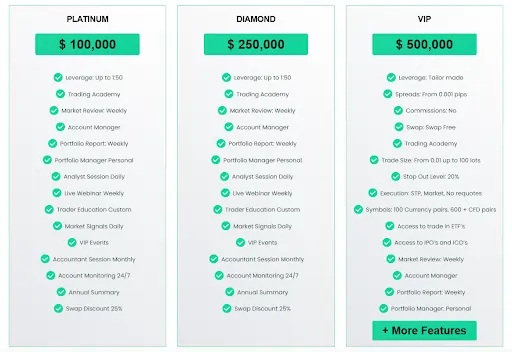

Platinum at $100,000 maintains all Gold features while adding monthly accountant sessions, 24/7 account monitoring, and annual summary reports. The accountant sessions help users understand tax implications and record-keeping requirements for trading activities.

Diamond at $250,000 mirrors Platinum features at a higher capital requirement. The main difference is positioning for VIP tier access rather than feature additions.

VIP at $500,000 completely customizes the experience. Leverage gets negotiated individually. Spreads start at 0.001 pips, far tighter than lower tiers. Zero commissions apply. Swap-free trading eliminates overnight holding costs. Access to ETFs, IPOs, and ICOs expands beyond standard CFD offerings.

Customer Support Breakdown

24/7 availability operates through live chat, phone, and email channels. Response times differ significantly by account tier. VIP users get priority handling with faster response times. Bronze users wait longer during peak hours when support queues build up.

The quality of assistance also varies. Bronze support handles basic platform navigation and technical issues. Higher-tier support includes market analysis help and strategy discussions. Another point to highlight in this Highmont-Group.com review is how support complexity matches account sophistication.

Expert advisors and analysts stay on standby for higher tiers. Users can request market opinions, ask about specific trade setups, or get second opinions on planned positions. This access becomes more valuable as trading complexity increases.

Educational Components

The trading academy structures content from beginner to advanced levels. Bronze users access foundational courses covering market basics, order types, and risk management fundamentals. Higher tiers unlock advanced content about complex strategies and sophisticated analysis techniques.

Weekly market reviews arrive for all account levels. These reports summarize the past week’s major market movements, explain what drove price action, and preview upcoming events that might impact trading. Reviews help users stay informed without spending hours researching independently.

Live webinars happen weekly for Gold tier and above. These sessions cover current market conditions, answer user questions in real-time, and sometimes feature guest analysts discussing specific markets or strategies.

Custom trader education for Gold and above personalizes learning. Rather than generic courses, users get coaching sessions focused on their specific weaknesses or knowledge gaps. Want to improve risk management? Get focused training there. Struggling with entry timing? Work specifically on that skill.

VIP events include networking opportunities with other high-level traders and exclusive educational content not available to lower tiers. These events build community among serious traders using the platform.

The Portfolio Management Side

Weekly portfolio reports document positions, performance, and exposure across different assets. As can be seen in this Highmont-Group.com review, Bronze users receive these reports but analyze them independently. Silver and above get portfolio managers who review reports together with users.

Personal portfolio managers for Silver and up actively monitor account balance across asset classes and strategies. They flag potential issues like overconcentration in single sectors or excessive leverage usage. Managers don’t make trading decisions but guide portfolio construction principles.

Strategy refinement happens through regular manager conversations. Discuss what’s working, what isn’t, and why. Managers help users identify patterns in their trading that lead to consistent profits or repeated losses. This external perspective often reveals blind spots traders develop about their own behavior.

Analyst and Accountant Services

Daily analyst sessions for Gold tier and above provide direct access to market professionals. It’s worth emphasizing in this Highmont-Group.com review that these aren’t automated reports. Users speak with actual analysts about specific questions or trade ideas.

Sessions cover technical analysis, fundamental developments, and risk assessment for planned trades. Analysts don’t guarantee outcomes but help users think through trades more completely before entering positions.

Monthly accountant sessions for Platinum and above address tax planning and record-keeping. Trading generates complex tax situations. Accountants help users understand reporting requirements, track cost basis properly, and organize records for tax preparation.

Annual summaries document the year’s complete trading activity. These reports simplify tax filing and provide performance analysis showing which strategies or markets produced the best results over twelve months.

Security Measures in Detail

Next-generation encryption protects all data transfers between user devices and platform servers. Segregated accounts mean user deposits stay separate from operational business funds.

Data privacy protections prevent unauthorized access to account information. Two-factor authentication adds another security layer beyond passwords.

Deposit and Withdrawal Process

Multiple payment methods accommodate different user preferences. Bank transfers, credit cards, and other options work for deposits. Lightning-fast withdrawal claims need testing against actual user experience. Processing timeframes vary by method.

Conclusion for this Highmont-Group.com Review

This Highmont-Group.com review examined a platform where the account tier determines the entire experience. Bronze at $10,000 provides basic access, while VIP at $500,000 unlocks completely customized trading with premium support.

The tier structure rewards larger deposits with progressively better features, tighter spreads, and more personalized service. Users need to assess whether features at their affordable tier level justify the platform’s higher entry requirements compared to competitors.

Read more: BrightLocal Review: Is It the Ultimate Tool for Local SEO Success?

Modern Solutions for Civil Engineering Projects

Smart Design at Sea: How Integrated Tech is Optimizing Space and Experience Onboard